Contents:

Another approach is to have students complete online modules or courses. Ultimately, the best way to teach accounting in high school depends on the student’s strengths and weaknesses. It mainly includes the ability to categorize things properly and enter financial information into accounting systems. No formal education degree or course is required to be a bookkeeper.

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. As the industry evolves and computer programs and systems are created and developed to make your job more efficient, your knowledge will grow too. In most cases, private companies do not pay more than the Big Four for young accountants with little experience. There are critical differences in job growth and salaries between the two.

There Are Several Job Possibilities Available In Accounting

While in the process of doing accounting work, you need to exert effort in understanding technical terms because you will use them almost every time in your future job. Additionally, a precise system that exposes the finances of a business or corporation is something that accounting students learn how to create, manage, and evaluate. But it would help if you prepared yourself for a lot of hard work because an accounting degree doesn’t come easy. Studying this major will put you on a pathway to becoming an accountant. Former Business.org staff writer Kylie McQuarrie has been writing for and about small businesses since 2014. Her work has been featured on SCORE.org, G2, and Fairygodboss, among others.

Many post closing trial balance-level jobs in accounting involve bookkeeping, for example. If you don’t like math or you’re not particularly good at it, then you’ll probably find accounting to be hard. Outsourcing the bookkeeping function is becoming more popular as business owners are struggling to find the necessary time and energy to maintain accurate books. Moreover, a quick online search can bring up various online courses for you to take, some of which are tailored to the software program you will be using. A basic bookkeeping course can cover what you need to know to get started. Certain bookkeeping tasks will be easy to complete while others may require extensive accounting and bookkeeping experience.

i found bookkeeping hard when i started out

These credentials will all take a significant amount of time and effort to initially obtain and may include meeting continuing education requirements to maintain that status. Bookkeeping is the process of recording the financial transactions of a company. Small business bookkeepers can provide a range of services from managing accounts receivable, accounts payable, reconciliation, payroll, reporting, income tax preparation, and more.

Trump’s Latest Dancing Partner: Those Trying to Indict Him – TIME

Trump’s Latest Dancing Partner: Those Trying to Indict Him.

Posted: Mon, 27 Mar 2023 07:00:00 GMT [source]

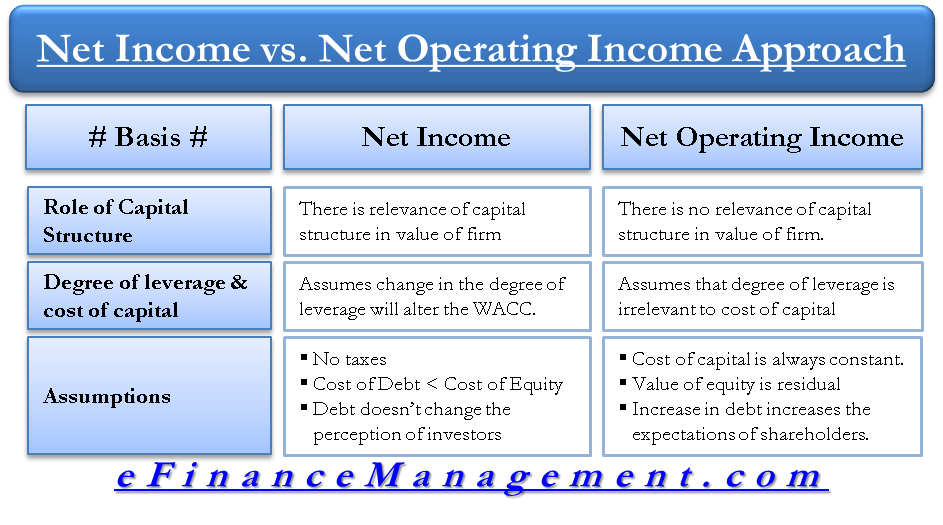

Theincome statement is developed by using revenue from sales and other sources, expenses, and costs. In bookkeeping, you have to record each financial transaction in the accounting journal that falls into one of these three categories. Companies also have to set up their computerized accounting systems when they set up bookkeeping for their businesses. Most companies use computer software to keep track of their accounting journal with their bookkeeping entries. Very small firms may use a basic spreadsheet, like Microsoft Excel.

Who Might Want to Consider a Career as an Accountant?

Communication between different departments is necessary to complete the bookkeeping in your business. Conversing with suppliers on invoices and customers on accounts receivable is a regular duty. The laws and regulations your business is subject to will impact the question, “how hard is bookkeeping? ” The government is concerned with payroll, sales, and income taxes in your small business, making full compliance a necessity.

- They often bookkeepers work a few jobs for various clients if they work as a consultant.

- Accounting is complicated for students since you must master many principles and regulations to manage transactions.

- Without bookkeepers, companies would not be aware of their current financial position, as well as the transactions that occur within the company.

- I’m going to university this for accounting and would like to start my own bookkeeping business on the side to earn money during university.

In particular, the big four firms of Ernst & Young, Deloitte, KPMG, and PricewaterhouseCoopers offer larger salaries than mid-size and small firms. Depending on the city, you can expect to earn between $40,000 and $60,000 your first year as a Big Four accountant. While the companies do not publish salaries on their websites, the benefits can be a large draw. For example, KPMG offers employees up to 25 days of paid vacation time, telecommuting opportunities, and a robust health insurance package.

Even if you are using an online system for bookkeeping, delegating an employee with keeping track of it on a daily basis is very important. Many of the processes, policies, and procedures include detail-oriented tasks to ensure financial accuracy. Then, kickstart your bookkeeping career by signing up for an Intuit Bookkeeping Certification. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

Prepare financial records and tax returns, evaluate them, and verify their correctness. Earning an accounting degree isn’t more challenging than earning a degree in any other possible subject. Others may believe accounting is challenging because they have been informed that it is simply a number-crunching job, similar to a human calculator. Accounting is technical, which is why during college, there are theories involved. Technical terms are so frequent that you will get used to them after you work in accounting for some time.

Accounting can become much easier over time with a focused effort and dedication. As an accountant, you’ll work independently on specific tasks, but after the data has been gathered, it needs to be provided to someone who can act on it. Most accountants collaborate with others or business executives who depend on them for financial guidance. Many people believe that accounting is challenging, including that it is challenging to learn, challenging to become an expert in, and challenging to pursue as a profession.

They are expected to meet tight deadlines and put in extra hours during busy times of the year, such as tax season. Even though you may feel like you have completed your formal education, the learning process does not end there. Accounting requires constant knowledge updating, whether staying up-to-date on regulations and laws or brushing up on the latest technology trends. Keeping pace with accounting’s ever-changing landscape can be difficult, but by continuously honing your skills and developing new ones, you can stay ahead of the curve. Many people believe that accounting is more complicated than computer science. This is mainly because accounting requires more complex mathematics and Critical Thinking skills than most computer programming languages.

… Or you will be wanting to run your own https://1investing.in/ practice to provide bookkeeping services to clients . Going into bookkeeping as a career means going into education, building your knowledge and confidence, and getting experience. When using bookkeeping software you may be able to get by without knowing much about the double-entry process which involves ledgers and journals. Best Google Certifications – a list of the best Google professional certifications to pursue and build job-ready skills. Companies in every industry need to work with bookkeeping specialists to ensure they can submit tax returns, and monitor their profit and loss over extended periods.

Meanwhile, accountants analyze the data from these records to provide sound tax advice. So while accountants occasionally tackle bookkeeping tasks, remember that this is not their primary role. It’s a common misconception that you need a formal education to be a bookkeeper, but anyone with solid math skills and the right resources can do it. Bookkeeping usually involves categorizing and entering financial data into an accounting system. So, if you’re planning to become a bookkeeper, here’s everything you need to know about it.

Even after 50 years, Reed has no retirement plans – Fallbrook / Bonsall Villlage News

Even after 50 years, Reed has no retirement plans.

Posted: Thu, 13 Apr 2023 03:55:08 GMT [source]

If you’re only focusing on expenses and not big-picture financial data, you’ll miss out on some strategic opportunities. Accountants advise leadership on how to make more strategic financial changes that save the company money or generate more profit. For some of the businesses that they do, accountants also need to be registered certified public accountants . Bookkeeping is the daily financial tracking of all of your daily financial transactions. The bookkeeper of a business might choose to use online bookkeeping software to track everything.

- Bookkeeping tasks provide the records necessary to understand a business’s finances as well as recognize any monetary issues that may need to be addressed.

- On the other hand, the purpose of accounting is o report the financial strength and obtain the results of the operating activity of a business.

- While most bookkeepers work with businesses, some individuals may also choose to hire a bookkeeper to track personal finances.

- There are critical differences in job growth and salaries between the two.

- Rasmussen University is accredited by the Higher Learning Commission, an institutional accreditation agency recognized by the U.S.

You can get your foot in the door by enrolling with Get Trained Get Hired which will open up a world of new career opportunities for you. Bookkeeping is an exciting occupation and one that is in high demand. Each day offers a new challenge for bookkeeping professionals which is what makes it such a rewarding career. As a financial auditor, you may work as an external or internal auditor.